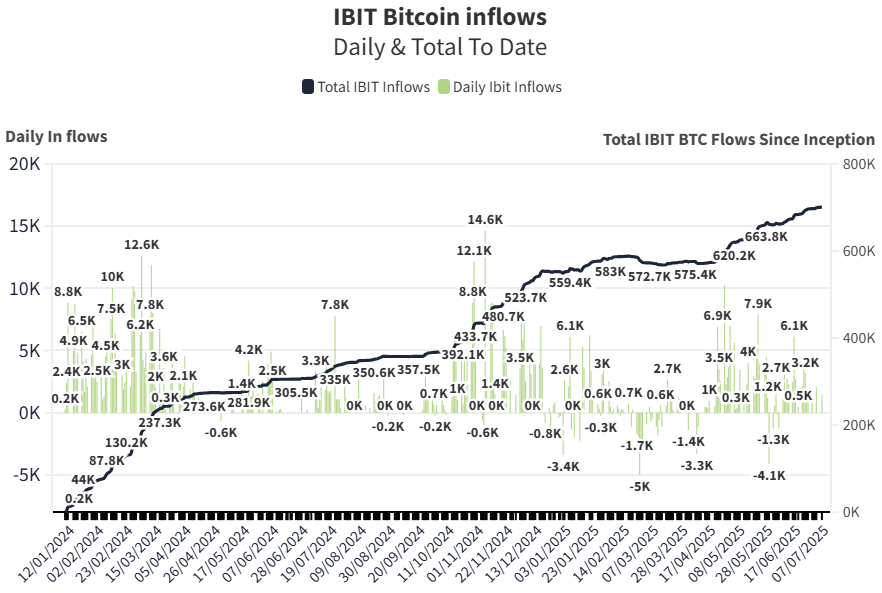

【贝莱德iShares比特币ETF持有量突破70万枚BTC】

BlackRock’s iShares Bitcoin ETF now holds 55% of the total Bitcoin held across all US spot Bitcoin ETFs.

贝莱德的 iShares 比特币 ETF 目前持有所有美国现货比特币 ETF 中总比特币持有量的 55%。

BlackRock’s spot Bitcoin exchange-traded fund has just crossed over 700,000 BTC, worth approximately $75.5 billion, after registering another $164.6 million inflow on Monday.

全球最大资产管理公司贝莱德的现货比特币交易所交易基金在周一再录得1.646亿美元资金流入后,已突破70万枚比特币的持有量,价值约755亿美元。

BlackRock, the world’s largest asset manager, now holds 700,307 BTC in its iShares Bitcoin Trust (IBIT) ETF, according to Apollo co-founder Thomas Fahrer.

Apollo联合创始人Thomas Fahrer指出,贝莱德目前在其iShares比特币信托(IBIT)ETF中持有700,307枚比特币。

Source(来源): Thomas Fahrer

BlackRock’s own iShares website shows IBIT held 698,919 BTC as of Thursday, and as such, the fund added 1,388 BTC in two trading sessions.

贝莱德官方iShares网站显示,截至周四,IBIT持有698,919枚比特币,这意味着该基金在短短两个交易日内增加了1,388枚比特币。

IBIT accounts for more than 55% of the total BTC held in US spot Bitcoin ETFs, according to Bitbo. Since its inception in January 2024, the fund has delivered a total return of 82.67%.

据Bitbo数据显示,IBIT占美国现货比特币ETF持有的比特币总量超过55%。自2024年1月成立以来,该基金已实现82.67%的总回报率。

The recent Bitcoin milestone comes amid reports that BlackRock now earns more revenue from its IBIT fund than its flagship S&P 500 fund, iShares Core S&P 500 ETF.

这一比特币里程碑的达成恰逢有报道称,贝莱德从IBIT基金获取的收入现已超过其旗舰产品iShares Core S&P 500 ETF基金。

Bitcoin hoarding outpaces supply

比特币囤积速度超过供应增长

Meanwhile, US Bitcoin exchange-traded funds, combined with Michael Saylor’s Strategy, the largest corporate holder of Bitcoin, have purchased more Bitcoin than the supply generated by miners almost every month so far this year, according to Galaxy Research.

Galaxy Research的研究显示,美国比特币交易所交易基金与最大企业比特币持有者Michael Saylor的Strategy公司合计购买量,在今年几乎每月都超过了矿工产生的比特币供应量。

Related: Strategy Inc vs. BlackRock: Which is the better Bitcoin proxy stock for your portfolio?

Strategy and the US Bitcoin ETFs have collectively bought Bitcoin worth $28.22 billion in 2025, while Bitcoin miners’ net new issuance has amounted to $7.85 billion during the same period.

2025年至今,Strategy和美国比特币ETF已共同购买了价值282.2亿美元的比特币,而同期比特币矿工的净新增发行量仅为78.5亿美元。

As of June, the combined entities have bought more Bitcoin than the new supply being generated each month, except in February, when the combined entities sold Bitcoin worth $842 million.

截至6月,这些实体合计购买的比特币持续超过每月新增供应量,仅有2月例外,当月这些实体合计净卖出了价值8.42亿美元的比特币。

Regulators warm up to crypto ETFs

监管机构对加密ETF态度趋于开放

Meanwhile, the United States Securities and Exchange Commission is reportedly looking to simplify the crypto ETF approval process.

与此同时,据报道,美国证券交易委员会正在寻求简化加密ETF的审批流程。

Under the new structure, ETF issuers will only need to file Form S-1 and wait for 75 days. If the SEC has no objections, the issuer can list its ETF on the exchange.

在新框架下,ETF发行机构只需提交S-1表格并等待75天。如果SEC无异议,发行方即可在交易所上市其ETF产品。

Earlier this month, REX-Osprey Solana and Staking ETF became the first ETF in the US to offer investors exposure to a staked crypto ETF, with investors being given exposure to SOL along with its staking rewards.

本月初,REX-Osprey Solana and Staking ETF成为美国首个为投资者提供质押加密ETF敞口的基金,投资者可同时获得SOL及其质押奖励的收益。

—————————————————————————————————————————————————————————

OKX(欧意):新用户注册且单笔存入 100 USDT,你将获得平台发放的 BTC 奖励。点击大陆或者国际(根据自己所在地选择): 中国大陆/Chinese Mainland 国际/Internationality

只有新用户有奖励

扫码跟单:

已注册的用户扫码会自动跳转到跟单页面,跟单前先添加联系方式,不然直接跟单进去可能会亏损